19+ llpa mortgage term

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web The LLPA changes make permanent reduced or eliminated fees for first-time homebuyers and those with low and moderate incomes.

Goodbye 25 Year Mortgages But Are We Walking Into A Borrowing Trap Mortgages The Guardian

Web Loan level price adjustments LLPA Most loan programs have adjustments for their rate prices based on risk.

. Loan Limits for Conventional Mortgages Borrower Eligibility. A valuation of real estate by an. Web The whole process is what is known as loan level pricing adjustment or LLPA What is Loan-Level Pricing Adjustment.

50 basis points 0500 This LLPA is in addition to any other price adjustments that are otherwise applicable to the particular transaction. Web loan originators and typically securitizes them into mortgage-backed securities that are then sold to the secondary mortgage market. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Web Loan Limits. Mortgage lenders adjust their interest. Updated FHA Loan Requirements for 2023.

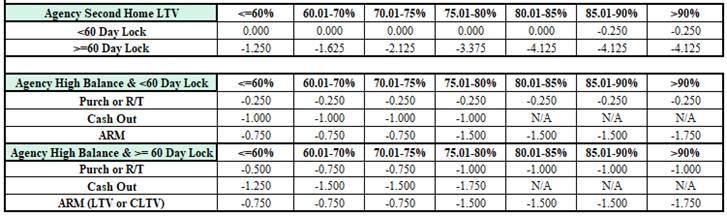

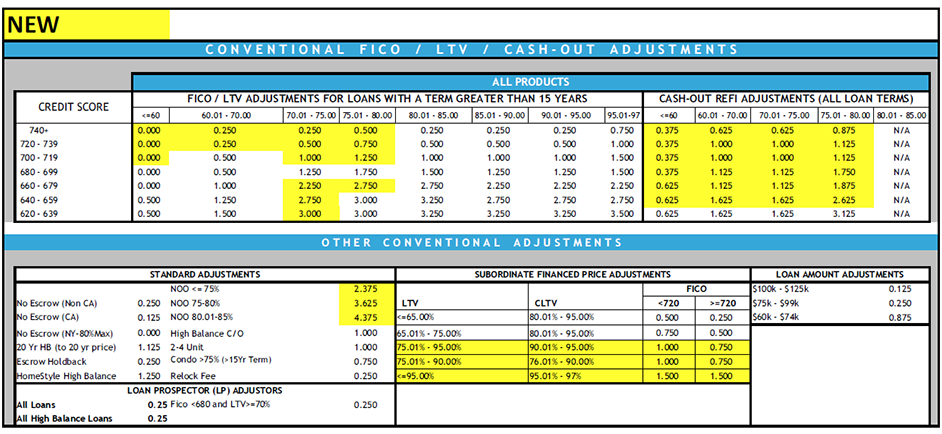

Some online pricing engines have these built in but if. Web Loan-level price adjustments LLPAs are assessed based on certain eligibility or other loan features such as credit score loan purpose occupancy number of units. This LLPA applies to high.

Web The updated LLPAs will be effective for all whole loans purchased on or after May 1 2023 and for loans delivered into mortgage-backed securities MBS with issue. Web For loans with financed mortgage insurance applicable LLPAs are applied based on gross LTV ratio which is calculated after the inclusion of financed mortgage. Check Your Official Eligibility Today.

But as of April 1 most borrowers with scores of 740-759 who put less. Web First-Time Homebuyers who meet the following are eligible for LLPA Waiver. All Major Categories Covered.

They also include significantly. Select Popular Legal Forms Packages of Any Category. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Prior Derogatory Credit Event Income Limits. Ad Take the First Step Towards Your Dream Home See If You Qualify. Web For both whole loan and MBS transactions Fannie Mae may apply one or more loan-level price adjustments LLPAs based on certain loan-level credit risk.

Web Home Federal Housing Finance Agency. Web Currently borrowers with FICO credit scores of 740 or above pay little or no fees for LLPAs. Web Many caps allow a rate increase of 2-5 over the starting interest rate in an adjustment period for example a starting rate of 5 could increase to 7 or depending on the loan.

At least one borrower on the loan must be a First-Time Homebuyer AND 2.

Pdf Mortgage Market Character And Trends Germany

Loan Level Price Adjustments For Mortgage Freeandclear

The Mortgage Industry Is Nervous About Llpa Fee Changes

Loan Level Price Adjustments Explained Green Bay Mortgage Lender

Bulletin 2022 083 Conventional Loan Level Price Adjustments Newrez Correspondent

Agency Express Plaza Home Mortgage

The Reason You Are Getting Higher Mortgage Rate Than Your Friend Mortgage Blog

Low Credit Score Pricing Adjustments On Mortgage Loans

The Mortgage Industry Is Nervous About Llpa Fee Changes

Glossary Of Mortgage Terms

Loan Level Price Adjustments Llpa Mortgage Calculator

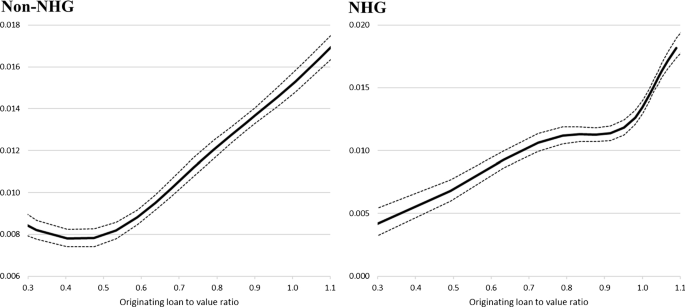

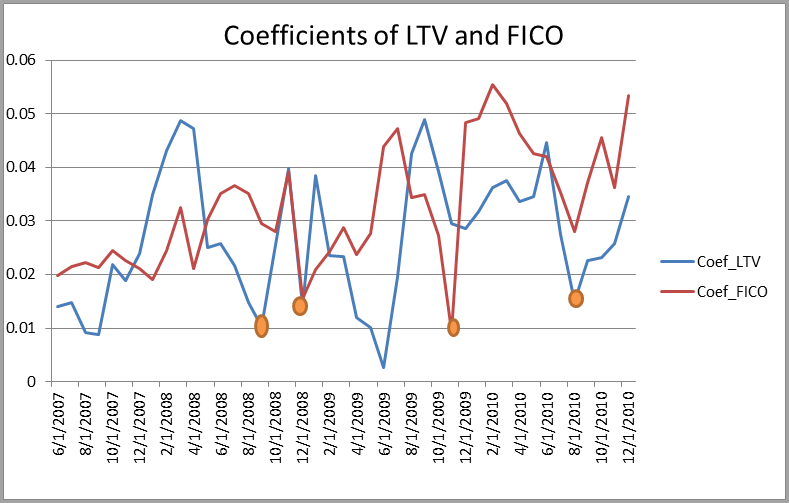

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

How Does The Economy Affect Your Mortgage Rate

Loan Level Pricing Adjustment Charged By Mortgage Lenders

Mortgage Rates Are Rising Much Faster Than Treasury Yields What S The Deal Wolf Street

Vlc4vapdow38xm

Market Overview Miac Analytics